In today’s market, there is a strong argument that loyalty is more important now than ever before. When delivered correctly, loyalty can be a very powerful way to positively influence your customers, and your bottom line. But it’s getting harder to achieve.

It’s been a decade of change for the banking sector. Ten years after the global economic crisis, two thirds of Brits (66%) still do not trust banks to work in their best interest, while in the US just 30% of consumers said they had ‘a great deal’ or ‘quite a lot’ of confidence in their financial institutions. With figures like these, it’s no wonder that many banks are struggling with loyalty in 2018. Changes to legislation such as the EU’s Payment Service Directives and GDPR, as well as many other initiatives across the globe, have also had a significant impact on the industry globally – placing further emphasis on the consumer and even incentivising switching banks.

At the same time, digital start-ups and fintechs are rising in popularity. Services such as Monzo or Starling in the UK, Ally or Chime in the US and N26 in Germany offer consumers highly competitive products and more insights and data on how they spend their money. For consumers, it feels like a more customer-centric approach.

It’s not just because today’s customer has more choice than ever before. It’s also that loyalty often sits across multiple business units. Marketing, brand, IT, partnerships and finance all have an important role in setting and delivering against an organisation’s loyalty strategy. And they all have different ideas, priorities and views on what needs reporting or what success looks like.

So, when you consider this complex, fast changing environment, it’s no wonder that true brand loyalty can sometimes seem out of reach.

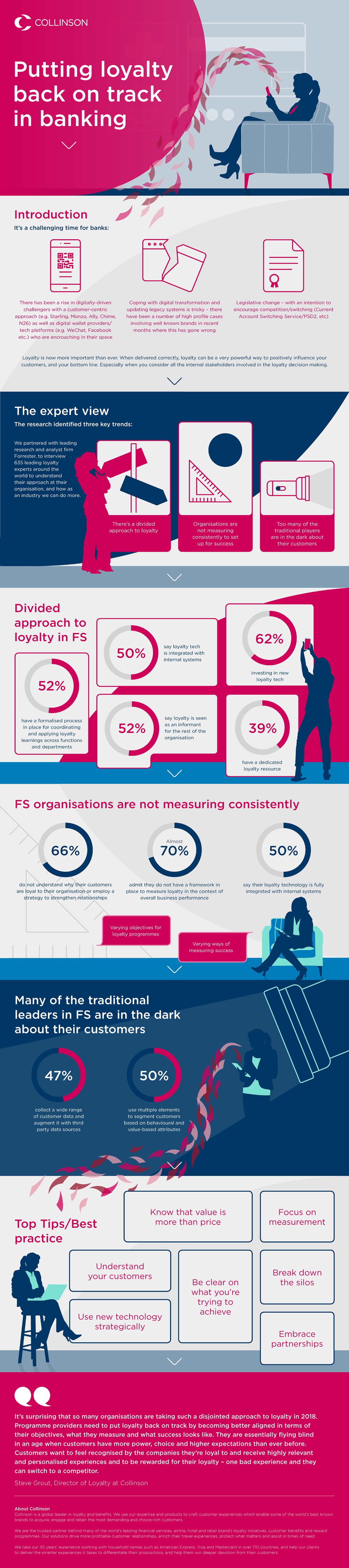

About this research

At Collinson, we believe in loyalty. We’ve been leading the way in the industry for more than 30 years. We are constantly listening to our clients, including Alpha Bank, American Express, Commonwealth Bank, Diners, JCB, Mastercard, UBS, and Visa, loyalty professionals and industry leaders to understand the challenges, gather new insights and identify actionable ways to help financial institutions improve customer engagement and loyalty. To complement this, we commissioned leading independent research and analyst firm Forrester Consulting, to interview 635 leading loyalty experts around the world. The objective – understand the trends, insights and challenges so we can support businesses as they strive to deliver a better loyalty experience for their customers.